- No news

- Business

- Budget 2025 Income Tax Slabs Update; Old Vs New Tax Regime | Salaried Employees

New Delhi5 days ago

- Copy link

The budget has given great relief regarding income tax. Under the New Tax Period, no tax will have to be paid on earnings up to Rs 12 lakh. This discount will be Rs 12.75 lakhs with standard deductions of 75 thousand for employed people.

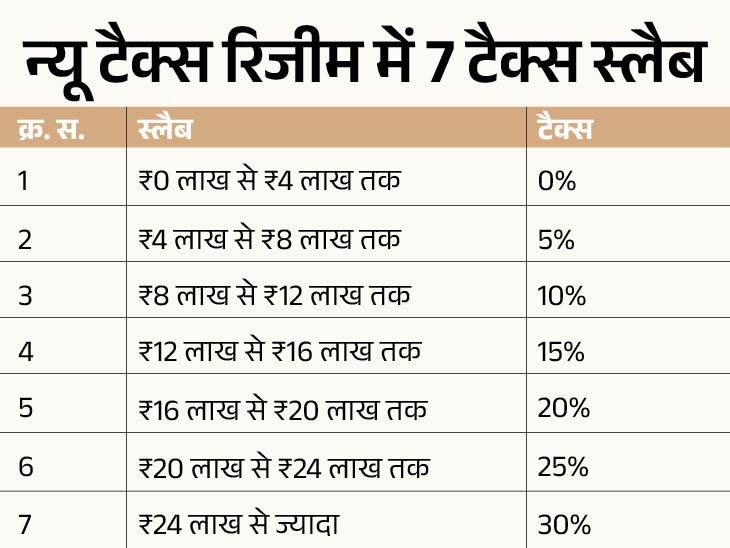

The slab of the New Tax Regyve has also been changed. There has been no change in the old tax regime.

However, a discount of up to Rs 12 lakh in the new tax regime has been given under Section 87A of the Income Tax Act. That is, under the new tax regime, the government will waive 5% tax on annual earnings up to Rs 4-8 lakh and 10% tax on earnings of 8-12 lakhs. This will benefit the taxpayer of 60 thousand rupees.

This means that if someone’s earnings are above Rs 12 lakh annually, then 5% tax on 4-8 lakhs will be added to his tax calculation and 10% tax on 8-12 lakhs. At the same time, the government will bring a new income tax bill next week.

Know how much tax will be made on you from Bhaskar Income Tax Calculator

Chartered Accountant (CA) Know from Sunil Jain, now your earnings will be levied and how much tax …

Capital gains will have to pay tax on income Suppose your total income is Rs 12 lakh, out of which salary and other income is Rs 8 lakh, but the capital gains income is Rs 4 lakh, then the tax exemption under section 87A will be given only at only Rs 8 lakh. Taxpayers will have to pay separate income tax on capital gains income of Rs 4 lakh.

These 8 major changes were also made due to income tax or tax

- TDS exemption doubles on income from rent: The limit of TDS has been increased from 2.4 lakh to 6 lakhs on the income from rent. That is, TDS will not be deducted on an annual rent of up to 6 lakh rupees.

- Senior citizens double on income from interest: The tax exemption received on the earnings from the interest of bank and post office to senior citizens has been increased from 50 thousand rupees to 1 lakh rupees. That is, now on the income of interest, senior citizens will get relief of up to Rs 1 lakh.

- Will be able to file returns for the last 4 years: The limit of filing old income tax returns has been increased from 2 years to 4 years. That is, if a taxpayer has filed his return wrong or is left to file, then he will now be able to fix this mistake by filing updated returns within 4 years.

- Self -occupied house will be benefited at two houses: Tax relief has been given at Self Occupide House in the budget. This means that if you have two houses and you live in both homes, now you will be able to take advantage of tax on both properties. Whereas earlier tax relief was available only in a self -occupied house.

- New income tax bill will come next week: The government will bring a new income tax bill next week. This will make the tax system much easier and transparent. The aim is to protect taxpayers unnecessarily notices and troubles. Along with this, the KYC process will also be made easier, which will lead to less paperwork in banks and other financial work.

- If there is no PAN number, tax will be levied: TDS and TCS were commonly used while selling goods. This caused many problems to both the customer and the shopkeeper. The Finance Minister has announced the removal of TCS from this. It has also been said that at high rates, TDS will be put in the same cases which will not have a PAN number.

- No tax on sending up to 10 lakh rupees abroad for studies: The limit of tax collected at source (TCS) has now been reduced to Rs 10 lakh on sending money for studies abroad. Right now a person sends money abroad. If this amount is more than 7 lakh rupees, then TCS is levied on it. However, you will get this discount only if this money has been taken loan from a financial organization like bank etc.

- Rebate on withdrawing money from NSS : Many senior citizens eat very old National Savings Scheme (NSS), on which no interest is being paid. The Finance Minister has announced that those who withdraw money from NSS on 29 August 2024 or after that will not have to pay any tax on withdrawal. The same rule will also apply to NPS (National Pension Scheme) Vatsalya accounts, but it will have a limit for exemption.

Now understand the old tax regime

On choosing the old tax regime, your income of up to Rs 2.5 lakh will still be tax free. However, under section 87A of the Income Tax Act, you will have to pay zero tax on income up to 5 lakhs.

3 questions related to old and new tax regime …

Question 1: What is the difference between the old and new tax regime? answer: In the new tax regime, the scope of tax free income was increased from Rs 3 lakh to Rs 4 lakh, but tax deductions are not available in it. At the same time, if you choose an old tax slab, then you can take advantage of many types of tax deduction.

Question 2: What kind of exemption is available in the old tax regime? answer: If you invest in EPF, PPF and Equity Linked Savings Scheme. So this income will be reduced from your total taxable income. At the same time, expenses incurred on medical policy, interest paid on home loan and Your money invested in national pension system Taxable income decreases.

Question 3: The old tax regime is better for people? answer: If you want to take advantage of investment and tax exemption, then the old tax regime may be better for you. On the other hand, if you want to avoid the hassle of low tax rate and tax deduction, then the new tax regime can be right for you.